Connect your integrations

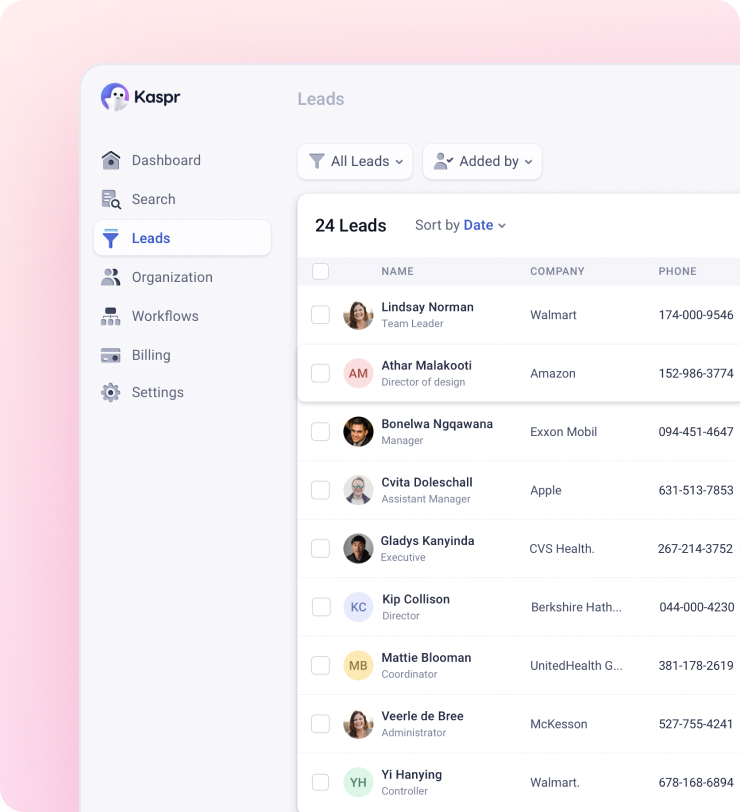

Manage everything via one platform. Your team, your clients, your leads, everything – Using just the Dashboard.

--

DESCRIPTION

DESCRIPTIONEuromoney Institutional Investor PLC (www.euromoneyplc.com) is an international business information group listed on the stock exchange and is a member of the FTSE 250 share index. Euromoney’s group of businesses covers asset management, price discovery, data and market intelligence, under brands including, Euromoney, Institutional Investor, BCA Research, Ned Davis Research and Fastmarkets. Euromoney also runs an extensive portfolio of large-scale events. Euromoney has revenues of around £400m, a market cap of about £1.2bn and approximately 1600 employees. The business is divided into six divisions: • Banking and finance • Telecoms • Institutional Investor • Investment Research • Fastmarkets • Specialist information Euromoney is known for its entrepreneurial culture – Euromoney people are creative, action-oriented, close to customers, passionate about their brands, knowledgeable about the industries they serve and accountable for their results. The company aims for what it calls “the best of both worlds” – complementing these entrepreneurial characteristics with the benefits that come from being a sizeable company; for example taking advantage of Euromoney’s scale, sharing best practice, operating strategically and creating career paths for staff across the whole company. Strong central functions alongside the business divisions are essential for this. In 2016, Euromoney outlined a new strategy to investors combining organic development and strategic and well-executed acquisitions and disposals. The company aims to allocate and recycle capital efficiently towards good, organic and inorganic opportunities via their “best of both worlds” operating model. Their ambition is to generate consistent and meaningful returns for shareholders at relatively low risk. The company headquarters are in London, with additional main offices in New York, Montreal, Hong Kong, Singapore and Shanghai. The group has a further 20 offices around the world.

ADDRESS HQ

ADDRESS HQLondon, United Kingdom

COMPANY NAME

COMPANY NAMEEuromoney Institutional Investor

WEBSITE

WEBSITE CREATION DATE

CREATION DATE1969

INDUSTRY

INDUSTRYInformation Services

SPECIALITIES

SPECIALITIESInformation & Data Services, Business Publishing, Financial Publishing, Training, Conferences & Events, Research, Journalism, Editorial, Sales & Business Development, data

LINKEDIN COMPANY PAGE

LINKEDIN COMPANY PAGEhttps://linkedin.com/company/euromoney-institutional-investor

Patterns

Patterns Example

Example Score

Score{first}.{last}@euromoneyplc.com

john.doe@euromoneyplc.com

15%

{f}{last}@euromoneyplc.com

jdoe@euromoneyplc.com

76%

| COMPANY | INDUSTRY | LOCATION | NO OF EMPLOYEES | ||

| Wolters Kluwer | Information Services | Alphen Aan Den Rijn, Netherlands | 10000 + | See company details | See employee details |

| Third Bridge | Information Services | London, United Kingdom | 1000-5000 | See company details | See employee details |

| S&P Global Market Intelligence | Information Services | New York, United States | 10000 + | See company details | See employee details |

| Visable | Information Services | Hamburg, Germany | 200-500 | See company details | See employee details |

| NielsenIQ | Information Services | Chicago, United States | 10000 + | See company details | See employee details |

Euromoney Institutional Investor has 2034 employees.

Euromoney Institutional Investor was founded in 1969.

Euromoney Institutional Investor's LinkedIn page currently has 20902 followers.

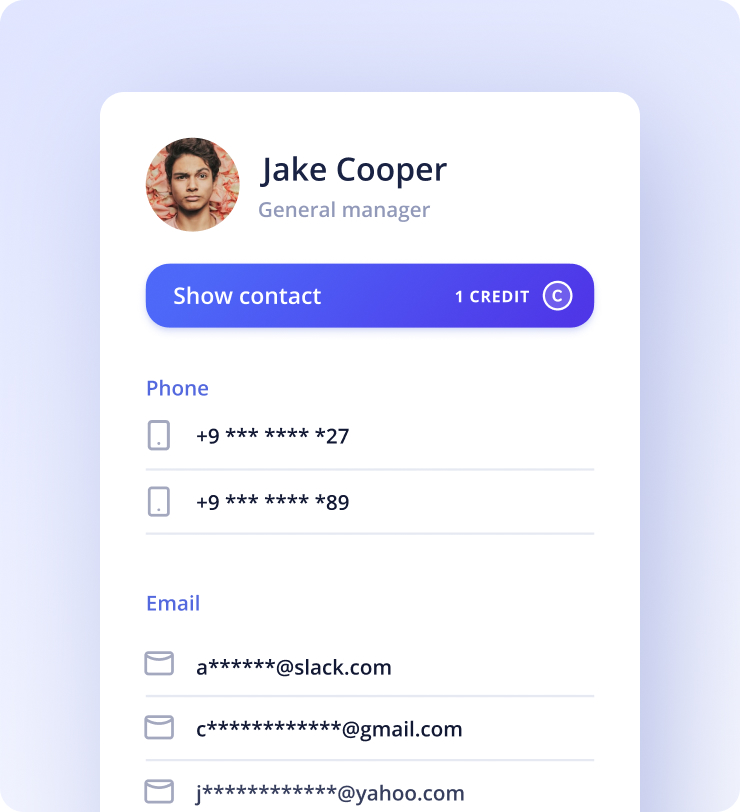

Kaspr will display your prospect’s contact information the moment you visit their LinkedIn profile. Quick! Isn’t it?

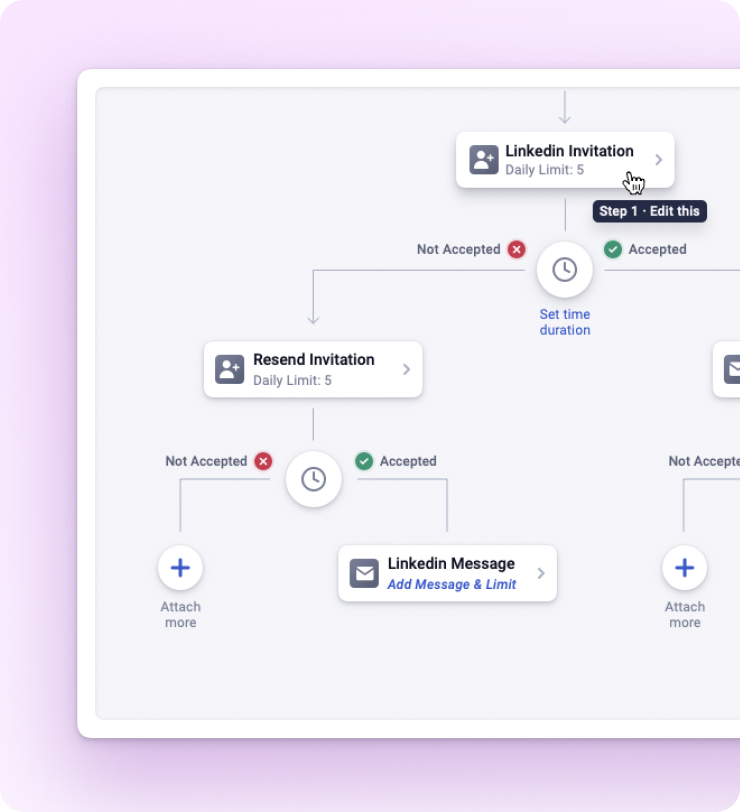

Kaspr lets you send automated follow up messages to your leads. Send them on your chosen day and time.

Manage everything via one platform. Your team, your clients, your leads, everything – Using just the Dashboard.