Connect your integrations

Manage everything via one platform. Your team, your clients, your leads, everything – Using just the Dashboard.

--

DESCRIPTION

DESCRIPTIONMTS is one of Europe’s leading facilitators of electronic fixed income markets, connecting a network of over 1000 unique buy- and sell-side participants across Europe and the US, with average daily volumes exceeding EUR 100 billion. The Italian Treasury devised and launched MTS in 1988 to enhance liquidity for investors and decrease funding costs for the public issuer. For the past 30 years, MTS has delivered a fully regulated, stable and scalable electronic infrastructure. It has pioneered e-trading for the professional bond market, delivering a flexible range of order types and access methods and supporting a wide range of instruments. MTS built its business by working closely alongside both issuers and market participants to establish a liquid, transparent and efficient market. It facilitates electronic trading for bond issuances in over 30 countries across Europe and the US, giving it a global view of the fixed income markets but with local expertise in each country. Innovation is at the heart of MTS. It leverages its expertise and experience to deliver trading solutions and market data that reflect the changing needs of rates, money markets and credit participants in Europe and the US. As market conditions continue to evolve, MTS prides itself on supporting participants on both the buy- and sell-side to meet demands from global regulatory authorities for improvements in risk management and compliance with new and pending regulations. MTS is part of London Stock Exchange Group (LSEG), the global markets infrastructure business. The Group’s diversified business focuses on capital formation, intellectual property and risk and balance sheet management. LSEG operates an open access model, offering choice and partnership to customers across all of its businesses. MTS has been a trusted facilitator of electronic fixed income markets for over 30 years.

ADDRESS HQ

ADDRESS HQLondon, United Kingdom

COMPANY NAME

COMPANY NAMEMTS Markets

WEBSITE

WEBSITE CREATION DATE

CREATION DATE1988

INDUSTRY

INDUSTRYFinancial Services

SPECIALITIES

SPECIALITIESFixed Income, Capital Markets, Technology Services, Electronic Bond Markets, European Government Bonds, Covered Bonds, Corporate Bonds, Interdealer, Dealer-to-client, Straight-through processing

LINKEDIN COMPANY PAGE

LINKEDIN COMPANY PAGE Patterns

Patterns Example

Example Score

Score{first}.{last}@mtsmarkets.com

john.doe@mtsmarkets.com

94%

| FULL NAMES | JOB DESCRIPTION | COMPANY | LOCATION | PHONE NO | ||

| Guido Galassi | Head of Data & Cash Product Management | MTS Markets | United Kingdom | g***@mtsmarkets.com | +44 0*** |

| COMPANY | INDUSTRY | LOCATION | NO OF EMPLOYEES | ||

| Amati Global Investors | Financial Services | Edinburgh, United Kingdom | 10-50 | See company details | See employee details |

| Ultimate Finance | Financial Services | Bristol, United Kingdom | 200-500 | See company details | See employee details |

| Azule Finance | Financial Services | Datchet, United Kingdom | 10-50 | See company details | See employee details |

| HSBC | Financial Services | London, United Kingdom | 10000 + | See company details | See employee details |

| Eurazeo | Financial Services | Paris, France | 200-500 | See company details | See employee details |

MTS Markets has 19 employees.

MTS Markets was founded in 1988.

MTS Markets's LinkedIn page currently has 4741 followers.

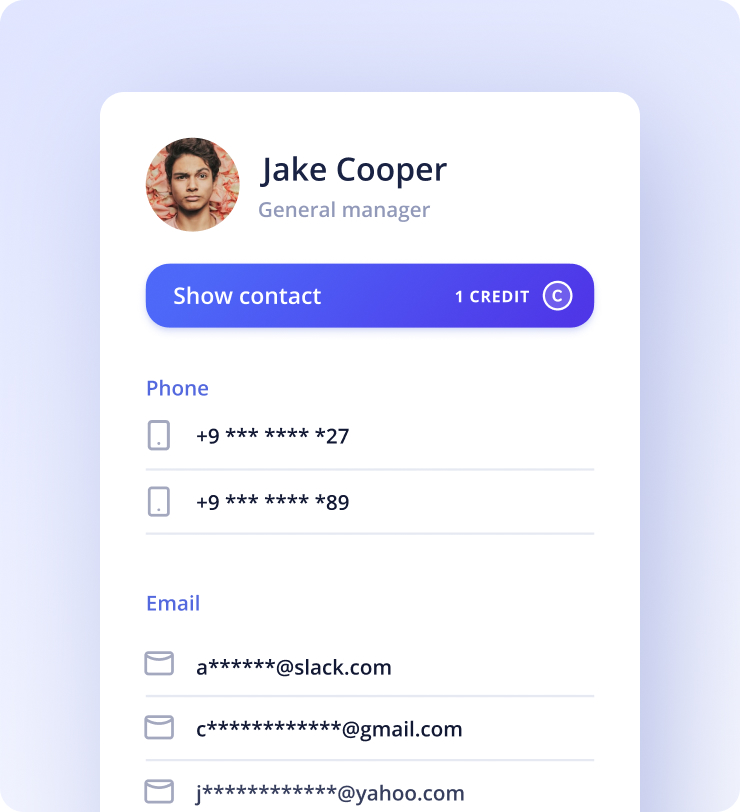

Kaspr will display your prospect’s contact information the moment you visit their LinkedIn profile. Quick! Isn’t it?

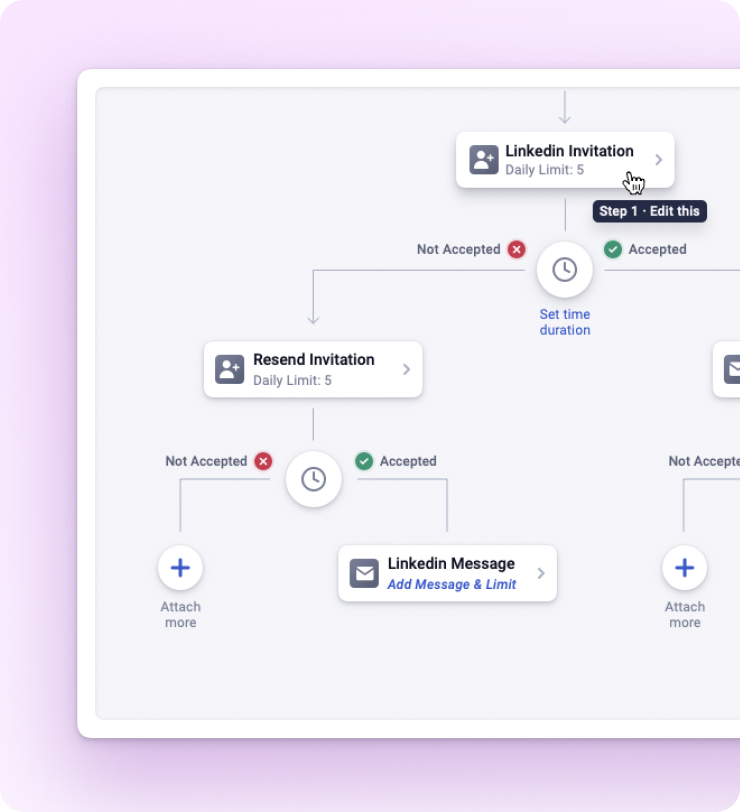

Kaspr lets you send automated follow up messages to your leads. Send them on your chosen day and time.

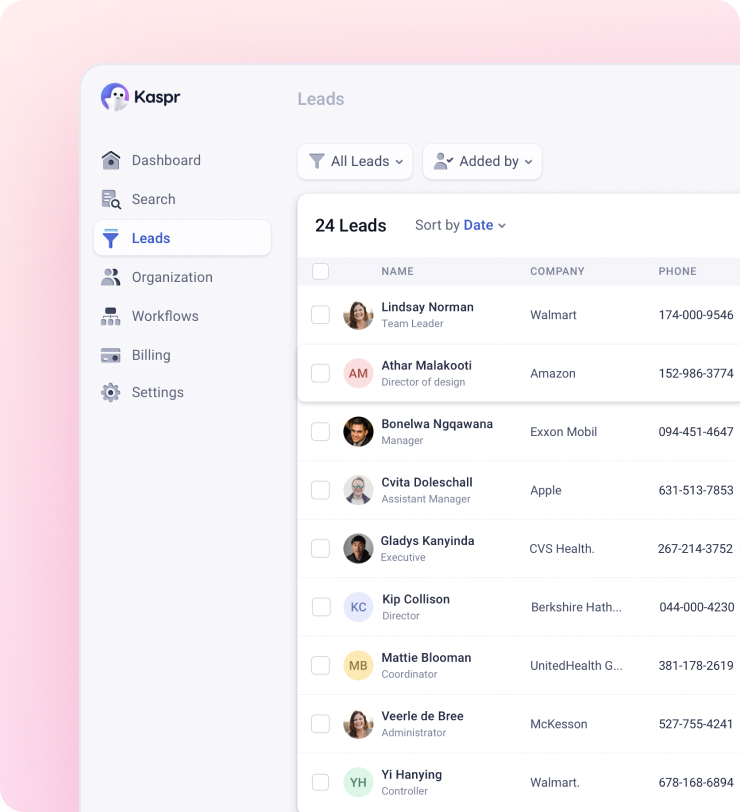

Manage everything via one platform. Your team, your clients, your leads, everything – Using just the Dashboard.