Connect your integrations

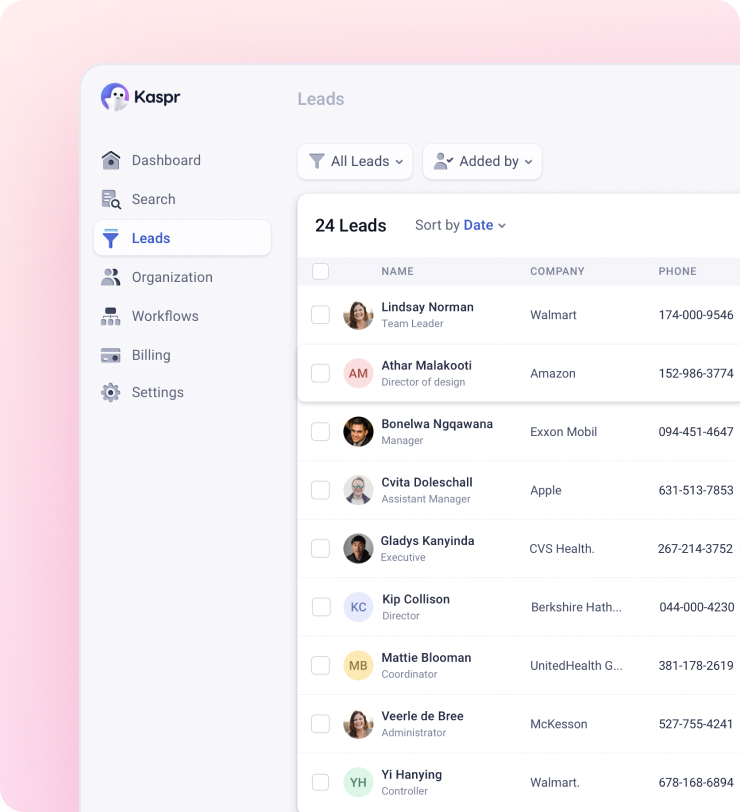

Manage everything via one platform. Your team, your clients, your leads, everything – Using just the Dashboard.

The ultimate global issuer-processor. For business at any scale.

DESCRIPTION

DESCRIPTIONPaymentology was born through a passion for exploring the complex engineering problems involved in today’s payment processing systems. Paymentology have developed what we believe to be the most flexible and most dynamic authorisation processing system available today. This enables “One for all” processing for companies requiring processing for complex card programs. Paymentology offers a state-of-the-art, fast next generation technology for payment processing. With more than thirty years of cumulated expertise within the finance industry along with close working relationships with MasterCard and VISA, the founders of Paymentology team are extensively experienced in the Issuer side payment processing ecosystem. The wealth of knowledge in the payments arena allows Paymentology to provide hands on expertise in program management and deliver robust and scalable relationships between Issuers, Program Managers, Acquirers and third party vendors. Our state of the art highly flexible processing engine provides the most robust and secure (tripple layer security (PCI, Tokenisation, Dual Factor Authentication) authorisation and rules based engine in the market. The Paymentology ecosystem is powered via multi-session authorisation engines ensuring extremely high resilience. Our Patent pending sensitive data isolation techniques ensure that cardholder data is more secure than in traditional systems. Our flexible rules engine is world class - Call us, to see for yourself.

ADDRESS HQ

ADDRESS HQLondon, United Kingdom

COMPANY NAME

COMPANY NAMEPaymentology

WEBSITE

WEBSITE CREATION DATE

CREATION DATE2015

INDUSTRY

INDUSTRYFinancial Services

SPECIALITIES

SPECIALITIESBanking, Payments, Cards, PCI, Multi Currency, Pre-Paid, Debit Cards, Credit Cards, Issuing, Contactless, Digital Banking, Fintech, Processing, PSD2, technology, innovation, AI, data, fraudprevention, bankingtechnology, Customer experience, FinTech, API processing, Payments Solutions, Open Banking, Financial Security, Digital Transformation, Banking App

LINKEDIN COMPANY PAGE

LINKEDIN COMPANY PAGE Patterns

Patterns Example

Example Score

Score{first}@paymentology.com

john@paymentology.com

47%

{first}.{last}@paymentology.com

john.doe@paymentology.com

53%

| FULL NAMES | JOB DESCRIPTION | COMPANY | LOCATION | PHONE NO | ||

| Felipe Vivacqua | CFO | Paymentology | United Kingdom | f***@paymentology.com | +44 5*** |

| COMPANY | INDUSTRY | LOCATION | NO OF EMPLOYEES | ||

| 3i Group plc | Financial Services | London, United Kingdom | 200-500 | See company details | See employee details |

| Blevins Franks | Financial Services | London, United Kingdom | 50-200 | See company details | See employee details |

| Curve | Financial Services | London, United Kingdom | 200-500 | See company details | See employee details |

| Mattioli Woods plc | Financial Services | Leicester, United Kingdom | 500-1000 | See company details | See employee details |

| YouLend | Financial Services | London, United Kingdom | 50-200 | See company details | See employee details |

Paymentology has 210 employees.

Paymentology was founded in 2015.

Paymentology's LinkedIn page currently has 20091 followers.

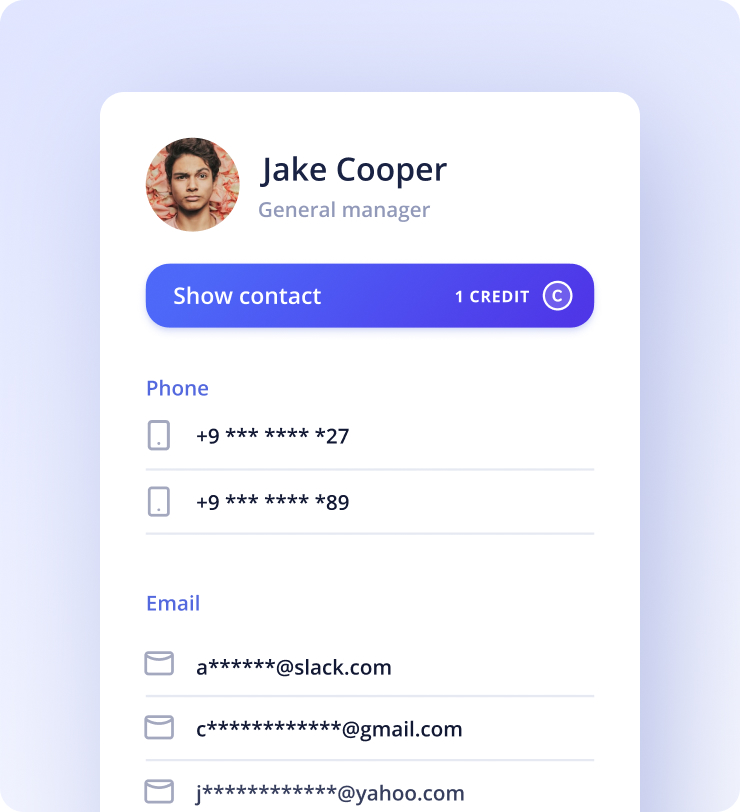

Kaspr will display your prospect’s contact information the moment you visit their LinkedIn profile. Quick! Isn’t it?

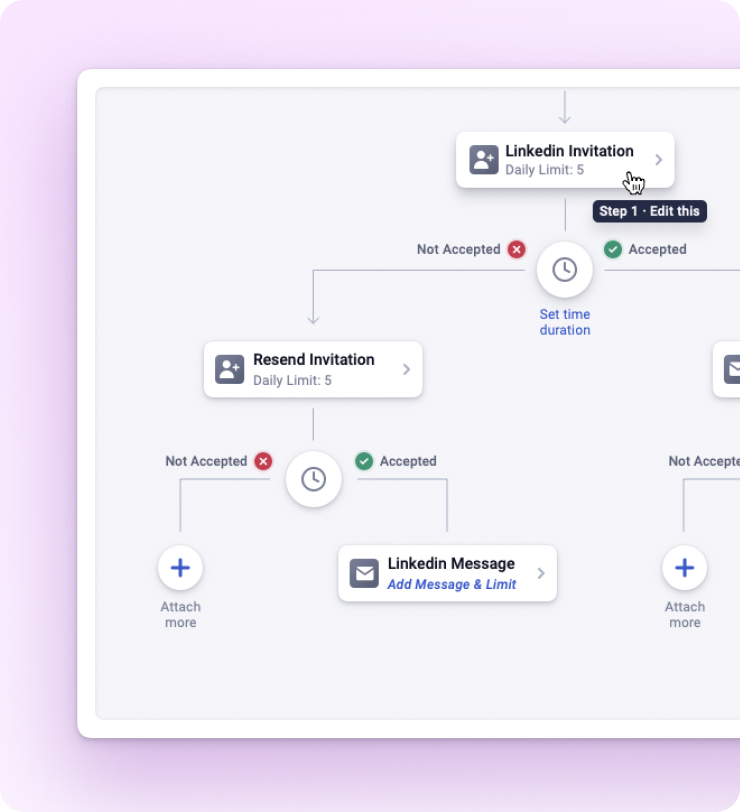

Kaspr lets you send automated follow up messages to your leads. Send them on your chosen day and time.

Manage everything via one platform. Your team, your clients, your leads, everything – Using just the Dashboard.